Your company is successful. But while revenue is growing, so are challenges you're facing. A greater reach globally reach means that you need to accept payments in more currencies and offer a range of payment methods. In addition, your growing network of international partners, agents and resellers requires tracking and accurate, timely payouts.

Finding success in business is hard earned. It shouldn't be hampered by inefficient or outdated payment practices. That's why it's worth investigating a payment ecosystem that will plug seamlessly into your revenue stack to automate and streamline your payments, partners and payouts.

Companies are increasingly opting for more automation, but a surprising number still use manual billing and receiving processes and checks for their B2B payments.

Moving to a omnichannel payments solution can simplify the typically cumbersome process surrounding order creation and the acceptance of payments while also minimizing manual data entry time and errors. It can also enable billing and take payments through whichever channel your customers or sales team prefers, whether online, over the phone or in person.

Here are the top seven benefits for companies that opt for a fully automated omnichannel invoicing and payment solution.

[pardot-form id="10272" height="190" width="600" title="Blog Form (Single field): Automated Omnichannel B2B"]

It's all about speed. Whether your customers are individual consumers or business clients, all buyers now expect easy access to online ordering, a fast checkout, and near frictionless payments. This is in addition to solid security, a range of payment options and quick, if not immediate, access to the products they have purchased. On the other side, suppliers and sales partners want to be paid, no one likes waiting for their money.

Whether your sales team is in the field, on the phone or in the office, an omnichannel payments application will allow them to configure client orders online and email custom links to a tailored and secure cart page for review, order completion and payment.

These customized cart pages enable immediate, secure online payment via debit cards, credit cards, online banking and alternative payment methods, and funds are immediately transferred. In addition, all sales activity is tracked in real-time, and all partner or agent commission management is automated, from attribution to actual pay out.

The entire payment ecosystem, from processing global payments, to tracking partners, to attributing and paying commissions, to detailed real-time sales reporting, can be all managed seamlessly with a solution that simply plugs into your existing tech stack.

By automating tailored customer invoice creation and emailing them their unique payment link with payment options like credit cards, debit cards, online billing and ACH, you can remove the delay associated with waiting for snail-mail payments, chasing NSF payments, filing copies and depositing checks. In fact, 56% of B2B ecommerce executives say they have certain customers they can only profitably support online.

Omnichannel payment solutions like Origins Ecommerce also incorporate features like integrations with multiple payment gateways that increase the chances of a customer payment being approved the first time. This gives you more certainty regarding when you'll have access to funds, allowing you to better plan your next strategic moves.

Similarly, for recurring payments, the billing period and price can be set through the payment platform. Charges are then automatically processed on the date set and any failed payments are then tried again through outlined retry logic and dunning management. This is all tracked and can be viewed in the platform itself or through an integration within your existing business systems.

An omnichannel payments solution means you can easily transition from invoicing for a single transaction to monetizing a subscription service with renewal optimization. Prices can be quickly changed, discounts offered and bundles adjusted when customer preferences shift.

Price points can also be discounted or different depending on the customer with proration available for different tiers of service, start dates or numbers of seats. Your channel partners, agents and sales team can create and send tailored links to payment pages in lieu of an invoice with instant online payment functionality on-the-fly.

In cases where the requestor and the authorized purchaser are different people, the unique link in the electronic invoice can also be easily forwarded to relevant decision makers to review and even complete the purchase immediately online.

If you want to expand internationally and leverage global channel partners, you can do so much more easily with an end-to-end payments platform which provides a localized experience delivering the custom payment link in your customers local currency and language and by supporting multiple payment methods. It's also important to provide multi-lingual billing support to your customers around the world.

Origins Ecommerce's platform also takes care of all international tax collection and remittance requirements, and handles all partner attribution and payout distribution no matter where they are in the world.

Security issues regarding payment information is a huge challenge. Data breaches are getting bigger and costlier. "We are predicting that ransomware is not going to decline, it will continue to increase in 2018, as per our threat research team," says Kevin Simzer, EVP at Trend Micro, a leading multinational cyber security & defense company.

Threats and the regulations to guard against them are constantly evolving. Your payment solution needs to keep up. Rigorous certification by the Payment Card Industry (PCI) helps ensure that credit card data security standards are met, while data center security processes can safeguard customer information.

With an automated omnichannel payment solution like Origins Ecommerce, you are making use of a PCI-DSS Level 1 Certified Service Provider, the strictest in terms of DSS (data security standards) requirements.

With massive data breaches like Equifax, it's expected that incidents of fraud will increase in the coming years. Fraud can be costly for businesses not only for lost products but also for chargeback fees. That's why it's important to monitor transactions for signs of fraud but this can be very time-consuming.

Built-in fraud mitigation helps to minimize the risk of chargebacks. Origins Ecommerce has over 300 fraud rules built through experience. The fraud team also has access to data from a larger set of companies and are able to spot and adapt to trends faster than individual companies are able to.

While some savings are self-explanatory, it may be easier to truly assess the potential of an automated omnichannel solution when viewed as an example.

A B2B SaaS company is growing sales internationally through a network of trusted partners. The company needs to accept payments from around the world as well as pay out its partners the correct amount. Traditional B2B payment processes include a lot of steps between you, your customer and your team of partners. Every step adds time and increases the odds of a mistake happening. Here's an example of the many internal steps and back and forth between a company and its customers with a manual payment process.

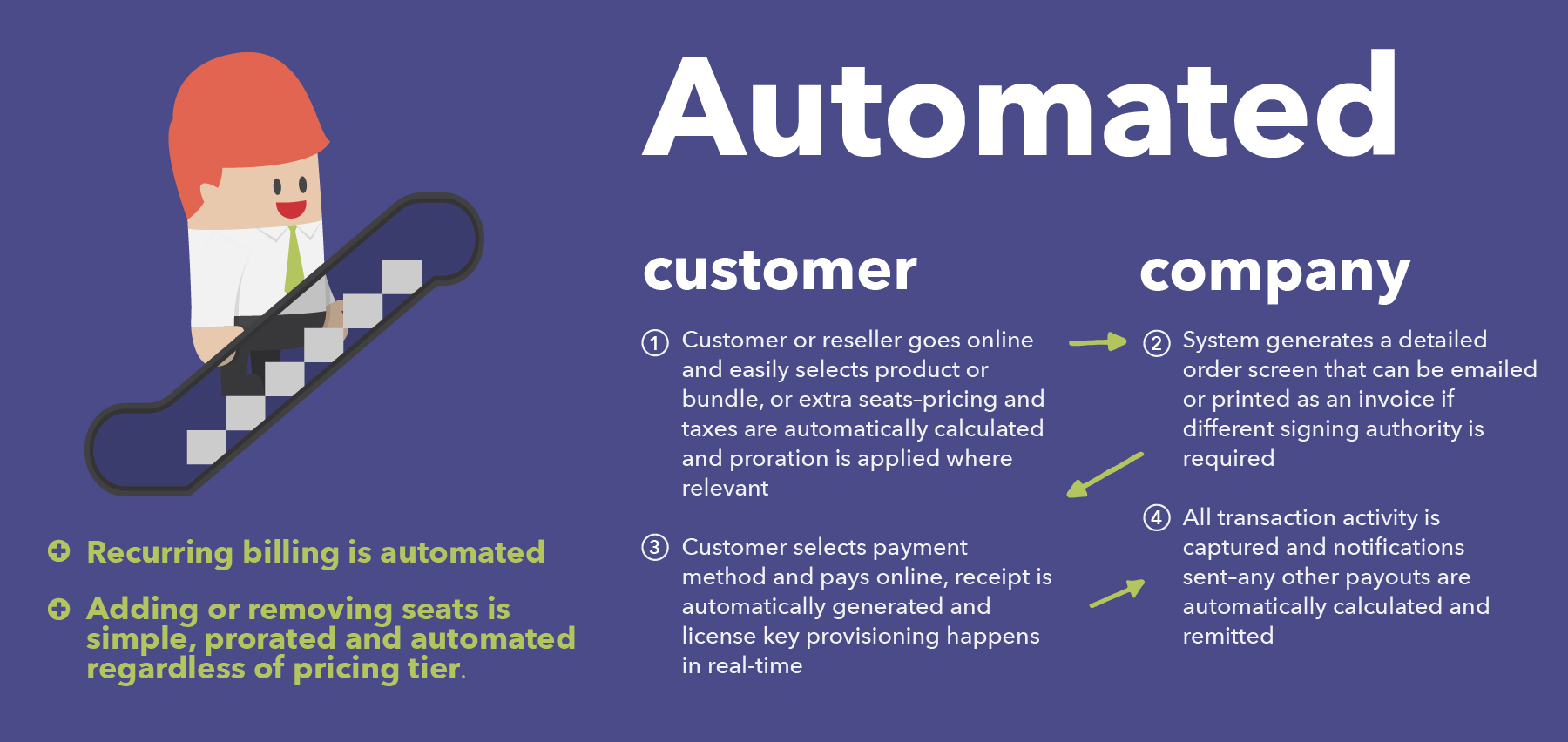

The difference with an automated B2B payment process is that much of the work with regards to payment processing, tracking and payout calculations is automated. This means fewer steps for your team and faster payments for your partners.

You need great relationships with customers and your sales partners and failed, late or cumbersome payments are one of the fastest ways to sour them.

With an automated omnichannel payment solution like Origins Ecommerce, there are fewer touchpoints and the process is faster for your customers and your partners. Our flexible API also means that our solution can integrate into your current business applications so that you can manage your payment ecosystem the way that works best for you.

If you'd like more information on the payment features that can help your business to keep growing, download our guide below which includes a comprehensive checklist. You can also check out our blog article on 11 Payment Headaches You Can Avoid with Automation.

[pardot-form width="600" height="280" id="10190" title="Blog Form: Automated Omnichannel B2B"]