Customer life-time value (CLTV) is an important metric for any business. Whether you’re selling funky dress socks, a consulting service, or a software subscription, CLTV will be a central metric in measuring the performance of your business.

There are a variety of ways to calculate CLTV, each with their own strengths and weaknesses.

In this post, we’ll explain what customer lifetime value is and how businesses can use a CLTV approach to increase ecommerce sales and return on investment (ROI). Let’s dive in.

Customer life-time value is more or less what it sounds like. It’s the revenue or value gained over the lifetime of a single customer.

You can be forgiven if your first reaction to that definition was, “so what...?.” Allow me to elaborate.

By understanding how much revenue on average is generated from a single customer you can understand how much you should spend on customer acquisition and on customer retention. Once you know CLTV, it takes a lot of the guess work out of PPC and correctly bidding on your AdWords. For example, if the average customer is going to spend $400 over the course of their lifetime, then spending $400 acquiring each customer isn’t going work.

CLTV is not without its drawbacks. Namely, it can be very difficult to calculate with any high degree of accuracy. Without a background in mathematics and statistics, even just looking at some of the more complicated formulas is intimidating.

But that’s not to say that simple CLTV calculations aren’t valuable. Even a formula as simple as Average Order Value x Average Number of Orders per Year x Profit Margin will provide a basic understanding of how much revenue a customer brings in on average. While it is not an especially accurate method of calculating CLTV, this can be a quick and handy way to approximate the value of a customer over a period of time (month, quarter, year, etc.).

There are several different ways to use a CLTV approach in ecommerce, but one of my personal favorites is the RFM framework. The RFM framework looks at three variables: recency, frequency, and monetary value.

Recency: the amount of time since a customer’s last purchase

Frequency: how many times per year a customer buys

Monetary value: the average order value per customer and profit margin

In short, improving any of these three variables will result in an increase in CLTV.

One of the first steps to building an RFM framework is to develop a scoring system for your existing customers and create a couple of segments based on behavior.

To do this you’ll need to export a spreadsheet of customer data, where each customer record includes the following fields:

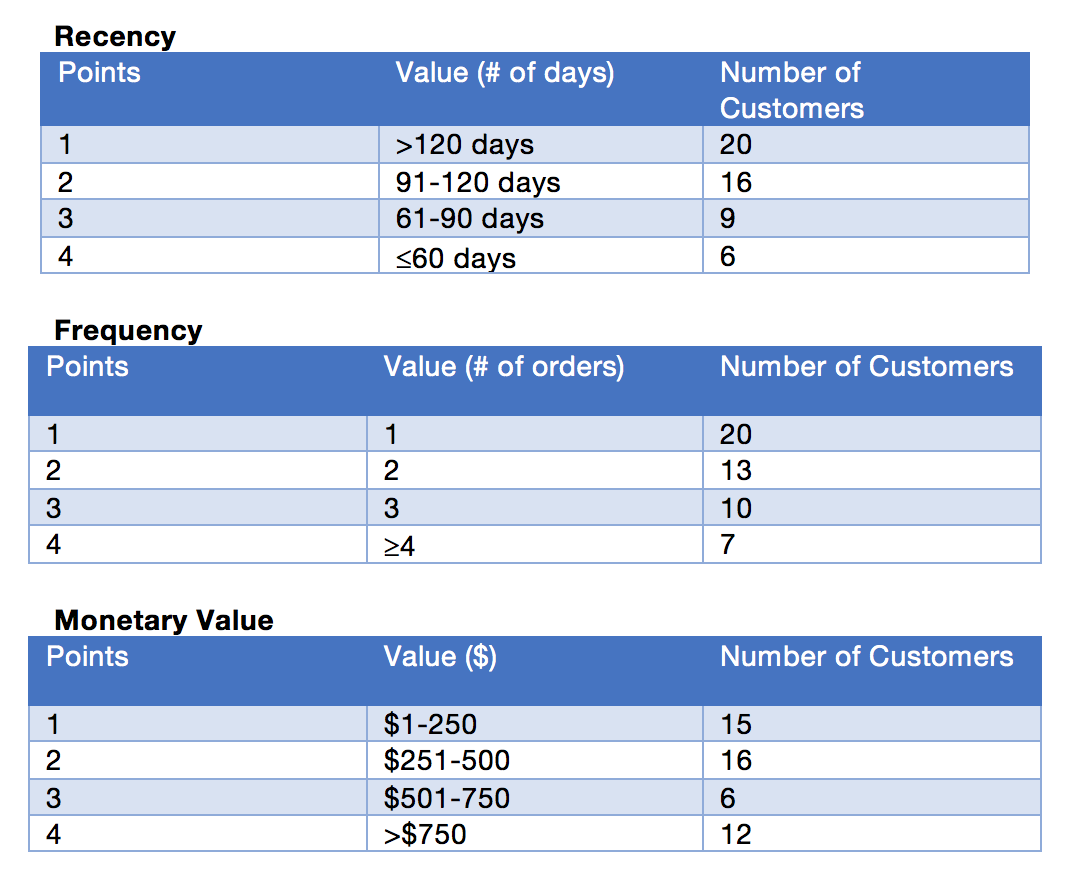

With this data, you can create a scoring system for each of the three variables in the RFM model. For instance, recency could be measured as the number of days since a customer’s last purchase where <60 days gets 5 points, 61-90 days gets 4 points, 91-120 days gets 3 points, and so on. Frequency is measured as the number of purchases a customer makes per year, so in this case 1 purchase gets 1 point, 2 purchases gets 2 points, etc. And monetary value can be measured as simply the value of each customer’s order, so a $1-250 order is 1 point, $251-500 is 2 points, etc.

At the end, you’ll have a table that looks something like this:

Now that you have an RFM model, what next?

An RFM model allows you to easily identify who your most valuable customers are. It shows you which customers buy most often, and which ones spend the most. Once you know who your most valuable customers are, you can ensure those customers have an exceptional experience and make them more likely to become brand advocates, spreading the good word about your company. Additionally, you can even target these customers with special campaigns and promotions knowing they are most likely to make a purchase. In either case, by identifying and targeting your most valuable customers, you will increase CLTV.

Many businesses invest a considerable amount of time and money into website analytics to provide information about which site pages and marketing campaigns drive the most sales, but how are your customers performing? With an RFM model you can identify trends within your customer base. For instance, if you have a high recency score, a low frequency score, and a high monetary value score, then your first-time buyers are driving the majority of revenues. If this is the case, then you may want to put more effort into customer retention rather than acquisition.

Multichannel businesses can take the RFM model even deeper by breaking down the data by channel. This will allow businesses to recognize the quality of customers coming from each channel and which channels produce the highest ROI.

The RFM model will also help you determine the incentive value you are willing to offer customers that recently abandoned a cart. For instance, high scoring customers with a shopping cart value above a certain threshold could quality for a steeper discount to complete the purchase. This not only helps to increase sales but ensures you’re offering an appropriate discount based on the value of a customer.

CLTV is an important metric for any business. By prioritizing a CLTV approach, businesses can identify their most valuable customers and channels, highlight insightful high-level trends about customer segments, and help to maximize customer value and ROI.