As consumers continue to embrace smart speakers like Google Home and Amazon Echo, voice commerce increases its foothold in the realm of digital commerce.

Findings released by both Visa and payment news publisher PYMNTS.com has revealed that the adoption of voice-enabled devices has nearly doubled since last year, climbing from 14% of the total consumer base to 27%.

The study, which was conducted to determine buying habits and shopping preferences of consumers, included approximately 2,800 adults in the United States aged 18 or older, and found that a staggering 96% of the participants currently own at least one connected device, with the average participant owning over four per household.

Additionally, as consumers increased the amount of voice devices like smart speakers in their home, so too did the amount of transactions occurring using that technology. One third of respondents who own smart speakers have used them to make a purchase in the past seven days.

While it may seem like younger demographics are the main reason for the increased adoption of voice-related purchases, the report interestingly shows that the contrary is happening. Those defined as “Bridge Millennials” (millennials that fall between the ages of 30-40) and early Gen X’ers (40-50 years) are actually more likely to be “Super Connected” (owning six or more smart devices).

The study goes on to acknowledge that there are more “Super Connected” women than men, with 57% and 43% adoption respectively.

Since Q2 2018, it is estimated that 25% of all US homes now include a smart speaker of some kind, translating close to 50 million adults.

The holiday season is expected to drive even more growth for smart speaker adoption, with 9.8% of shoppers who don’t currently own a device claiming that they plan to purchase one before the end of the year.

As more people stock up their supply of voice assistants in the home, expect linear growth in terms of voice-related transactions. Data from OC&C states that voice commerce, which is currently valued at a $2 billion industry, is poised to hit the $40 billion mark by 2022 – that’s a 1900% increase.

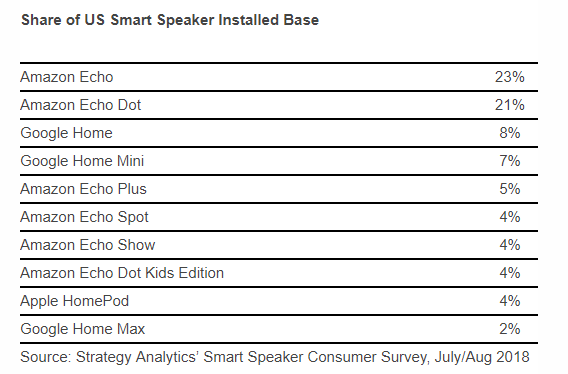

From a device standpoint, Amazon holds the lion’s share of the voice market, consisting of 63% of all smart speakers actively in use. Google takes second place at 17%, and Apple has a tall hill to climb at third, reaching only 4% of the US smart-speaker market, as per a report by Strategy Analytics.

Image Source: Business Wire

That same report also shined some insight on just where in people’s homes they’re using their smart speakers. 62% of people place their smart speakers in the family room, 41% in their bedroom, 39% in the kitchen, and the remaining 12% in the bathroom.

There is a lot to process with these findings, but in summary – marketers and brands alike should start to prepare for voice-related searches to soar. This means taking the time to ensure that your allocating resources to make your product and brand search terms a little more “voice friendly”.

Start researching new, more conversational terms using Google’s keyword planner. Use that data to optimize both your organic optimization efforts and your paid campaigns.

From a targeting standpoint, there are also lots of takeaways to glean. Once you locked down some vocal search terms that resonate with your objectives, consider gearing them towards the age brackets listed above. People in between 30-50 are the biggest users of voice commerce right now, so don’t neglect them just because a younger audience might be more tech savvy. After all, it’s that demographic that has the purchasing power.

Ultimately, voice is here to stay, so making adjustments now to accommodate for the change will almost certainly be more lucrative than waiting and playing catch up.