B2B SaaS companies are facing a variety of pressures. Competition is getting more fierce, technology is constantly changing, customer expectations are continually growing and customer acquisition costs are rising. This all means that it's more vital than ever to not only to attract customers but to keep them happy so that they stay signed up.

But trying to ensure that your customers have a great experience with every touchpoint with your business while not getting bogged down in the day-to-day logistics of a growing and increasingly complex company can seem daunting.

I've talked to a lot of software companies lately that are struggling to keep up. B2B companies want to give users the ability to self-manage their products online so that they can get immediate value. Whether it's a first-time purchase, or upgrading a few seats for new employees, giving customers the ability to easily manage their subscription is key.

If you've been selling your software "out-of-a-box," using one-time license keys, keeping track of orders with Excel or requiring customers to talk to a sales representative to adjust their seat count, there is a better solution.

Companies like Microsoft, Salesforce, Adobe and other industry leaders have already done a great deal to optimize this process, both at a B2B and a B2C level. They've given their customers the ability to self-manage their software subscription. Need 5 more seats? There is no longer a need to call a representative, who will create a purchase order that then needs to be signed. It can all be done right away online. But how do companies that don't have the budget of a Microsoft or Salesforce give their customers the same ability? By creating a revenue stack.

While many organizations have a solid understanding of what value a revenue stack provides, others have been more skeptical it's worth their time. After all, is this just a fad or is it part of an evolution of the industry? Others think their payments work fine, so why should they care?

Here's how a revenue stack could make an impact on your business' bottom line and help you provide better value for your customers.

The basics of a sales funnel has not drastically changed. Marketing still generates leads and sales works to convert those leads. With SaaS products, however, companies now also have to ensure ongoing customer success.

The traditional software sales approach tends to have marketing, sales, customer success and payments in different departments with separate technology stacks, different KPIs and measurements of success.

These silos are reinforced with many companies still relying on old, paper-based methods for payments to and from other businesses and partners. Take an example of a managed service provider (MSP) that just sold 50 seats of a cloud software product. They secure a sale with a client and issue an invoice with the agreed-upon specifications. They get a PO back and the cloud software customer service team is then instructed to turn on 50 licenses, which they send in an email CSV.

But payment is not immediate. After a month with no payment in sight, the MSP follows up regarding the late payment. When the payment finally arrives via check, credit card or other payment method, more time has elapsed. If the transaction is successful, the MSP then pays out the software company for the seats provided based on the agreed revenue share. Then, when it's time to renew the licenses in 6 months or a year, the process will start all over again.

This model is slow, error-prone and segregates data about customers as they travel through the sales pipeline in different stacks, which limits the insights that decisionmakers can gain to inform their strategy.

[pardot-form width="600" height="190" id="10452" title="Blog Form (Single field): Revenue and Payment Stacks"]

A revenue stack uses APIs to tie together and align all the components related to generating revenue from lead generation through to conversion, payment and renewal. It allows companies to have a better view into the effectiveness of the different parts of their sales cycle and be more agile when strategies need to change. It also ensures a consistent experience for customers and partners.

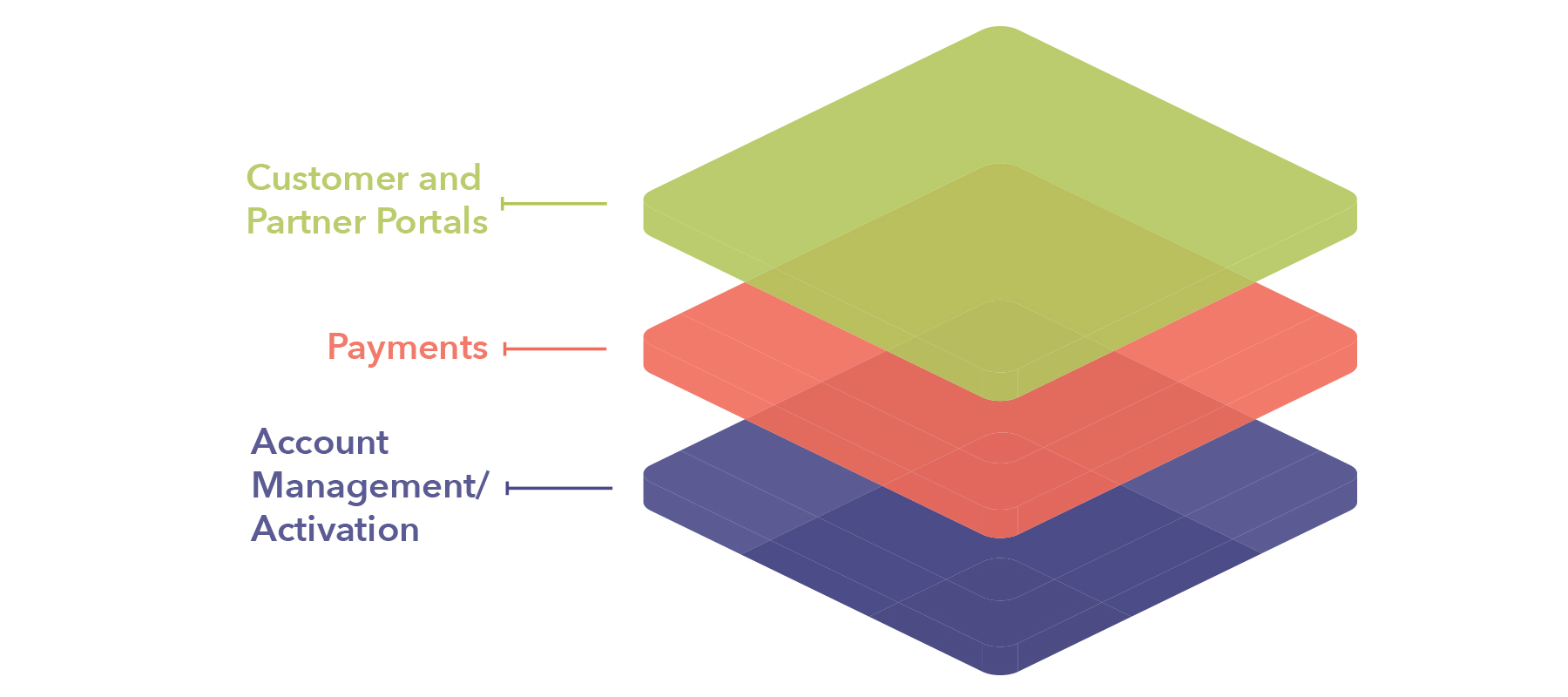

The three key components of a revenue stack are:

In the example above with a revenue stack solution, an MSP would log into a portal where they're able to quickly create and issue a customized invoice with a PayLink attached (a PayLink allows the client to pay immediately via the invoice with different online payment methods like credit cards, ACH, etc.).

Upon issuing the invoice, an account is automatically activated and credentials sent to the buyer. Recurring payments can be set up and automated through the payment platform with different billing periods, price points, one-time fees or coupons options. The result is giving your customer control of the products they want, when they want them.

In addition to allowing you to give clients a better payment experience and instant access, it also enables you to empower your partners to cross-sell other products.

A revenue stack integrates related technology stacks together.

A revenue stack uses APIs to pull together three core functions - customer and partner touchpoints, account management and activation, as well as the actual payments themselves.

Customer and Partner-Facing Portals

These are the actual touchpoints with your customers and partners whether it's a checkout page, your product interface or a portal for your partners selling or integrating your product.

Depending on your business model, you could have a variety of portals for different needs. These could include separate portals for accessing your product, initial payments, client subscription management and partner management. These need to be consistently branded, able to perform the task needed and linked to the relevant systems to give you adequate oversight. User permissions on the payment platform can give you the ability to empower partners by allowing them access to your payment solution so they can quickly convert a sale.

With regards to portal management, the gold standard for me is still Impartner – they are cutting edge when it comes to portal capabilities.

Payments

Payments should never be a barrier for business growth and at the center of your revenue stack, you need a powerful payment engine. Your payment solution needs to be able to accept customers' preferred payment options and you and your sales partners also need the flexibility to adapt invoices for specific clients. On top of this, you need to ensure all security and fraud standards are met as well as payouts for taxes and to your partners happen correctly and on time.

Account Management/Activation

An optimzed revenue stack links client payments, your CRM or ERP system like Salesforce and Microsoft Dynamics and your actual software license activation for a faster, more streamlined process. This is also the place where all your data flows through so you can more easily see if accounts are still current, referral sources and if there are any opportunities for expansion revenue or a risk of churn.

The core principle behind a revenue stack is it can automate and integrate together many processes many are still doing manually. This is especially the case for those selling software. There are a lot of SaaS solutions that can help with different aspects of your sales funnel. The key is finding a robust and flexible payment solution that can plug seamlessly into your other platforms for an optimized revenue stack.

Because it can save you and your team time, which is the most precious resource you have. When you're evaluating if you need a revenue stack, consider if certain processes could be automated. Are we giving our customers the best chance to succeed with our product? Are we empowering our partners and giving them the tools they need to help sell and promote our product?

The exact way that a revenue stack is configured will be different for every business. The key is finding the payment solution that can adapt to you and can help you set up a solution that empowers your company's growth.

If you're looking to take advantage of the value an optimized revenue stack can provide and need a payment engine at the center of it, I would love to chat.

[pardot-form width="600" height="280" id="10450" title="Blog Form: Revenue and Payment Stacks"]