Many are satisfied that this system works well enough as is and provides them with all they need, and that may indeed have been the case 10 years ago when software literally came in boxes. Today, however, most B2B SaaS Business Models are much better served with a comprehensive revenue stack that helps them drive online sales.

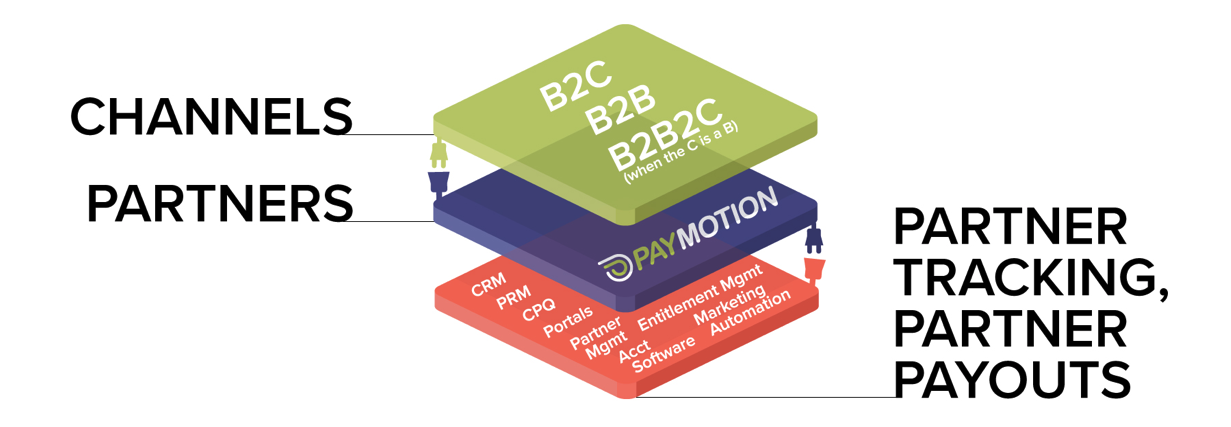

From streamlining recurring billing and payments to managing and paying out resellers and partners, the realities of selling a software subscription requires the cohesive working of a number of elements in order to deliver an exceptional user experience.

There has a been a rush to cloud in recent years for a number of reasons including mobility, security, compliance, ease of management and the fact that it's a hardware agnostic environment to name a few, and B2C companies have been quick to both see and take advantage of these benefits. Not so much B2B payments however, which have largely lagged behind continuing to plod along with snail-mail, 30-90 day payment terms, check payments with associated clearing issues, manual data entry and other somewhat antiquated processes in light of the modern digital world. Apart from the obvious costs associated with this approach, there is the added cost of potential lost revenue and missed conversions as customer expectations and purchase behavior have shifted dramatically.

Payments are the glue between your sales partners, users and the applications that drive your business. They can also help mitigate churn by minimizing failed payments. This is why it's imperative to look at the creation of a revenue stack as a system. As software evolves, it's the system-as-a-service, not your legacy code, that will grow your business.

Revenue stacks essentially bring all of your sales, billing, payment and reporting solutions together so you can gauge the effectiveness of your entire sales funnel and alleviate back office pressures regarding pay outs and compliance. A solution like Origins Ecommerce, for example, is able to integrate into your existing business systems while giving you the flexibility and automation needed to support your business strategy to grow sales.

[pardot-form width="600" height="190" id="10452" title="Blog Form (Single field): Revenue and Payment Stacks"]

In B2B SaaS, an out-of-the-box payment solution has both advantages and challenges compared to a solution you build on your own. I'm lucky enough to work for a company that has an adaptable product that responds to both the need for customization to fit different business needs as well as being out-of-the-box.

Here's what I notice in the B2B SaaS space: with an out-of-the-box solution, you may have to rely on APIs to handle any gaps. But this can usually be done quickly. For example, getting set-up and transacting at speed and scale in a week is possible with an out-of-the-box solution.

The primary benefit of building a revenue stack is it gives you the ability to create a customized solution to fully meet the needs of your business. No loose ends or hacks. Imagine it as creating a system as a service for your end user.

A payments partner in B2B SaaS is someone who understands your business model and creates a system that enables you to transact at speed and scale. They should understand that there isn't a one-size-fits-all solution and that customization is going to play an important role in your success.

They should be fully aware of the fact that your business model includes sales partners and numerous channels and that they will be required to do more than just quietly process payments. A true payments partner will enable you to provide your users and resellers a higher level of service by automating payment processes.

The payments space is also highly regulated and mistakes can have hefty and costly consequences. A partner which adheres to compliance best practices and can point out potential risks is an invaluable ally.

Here's some basic info if you're interested in learning about how Origins Ecommerce can handle your B2B partners, or dive a little deeper by downloading one of our free reports below.

[pardot-form width="600" height="280" id="10450" title="Blog Form: Revenue and Payment Stacks"]