Creating and growing any type of business is hard, but SaaS companies have it particularly tough.

Unlike most other businesses, SaaS companies must learn to survive on small subscription payments accumulated over a long period of time. For this reason, SaaS more than any other industry requires entrepreneurs to carefully track every single penny going in and out of the business.

At the same time, it’s easy to get overwhelmed by all the fancy metrics and indicators out there, especially when it seems like every week a new one is popping up – so where in the world should you start?

The good news is that for most companies, there are a few key metrics that serve as the foundation to your growth efforts. In this article, we’ll look at the four most important metrics that every SaaS business must measure to maximize success.

SaaS companies need a stable flow of revenue to survive. Monthly recurring revenue is a simple, consistent metric that allows you to keep track of all the money coming in, regardless of how complex your business model becomes over time.

For some SaaS providers, calculating MRR can be as easy as adding up all incoming revenue each month. However, most companies will benefit from tracking multiple MRR numbers, especially if they have variable pricing plans or supplementary offerings.

Common MRR metrics include:

Each of these MRR numbers corresponds to a different business function – such as external sales, internal sales and customer success – so tracking all of them will allow you to identify specific opportunities for improvement.

In addition, comparing these MRR numbers against each other can allow you to assess the overall health of the business. If Churn MRR is higher than New MRR, that means you’re losing more customers than you’re gaining each month, and your software is probably not providing customers with enough long-term value.

On the other hand, if your Expansion MRR is higher than your Churn MRR, that means you’ve figured out how to grow existing accounts faster than you’re losing customers – a key milestone for SaaS sustainability.

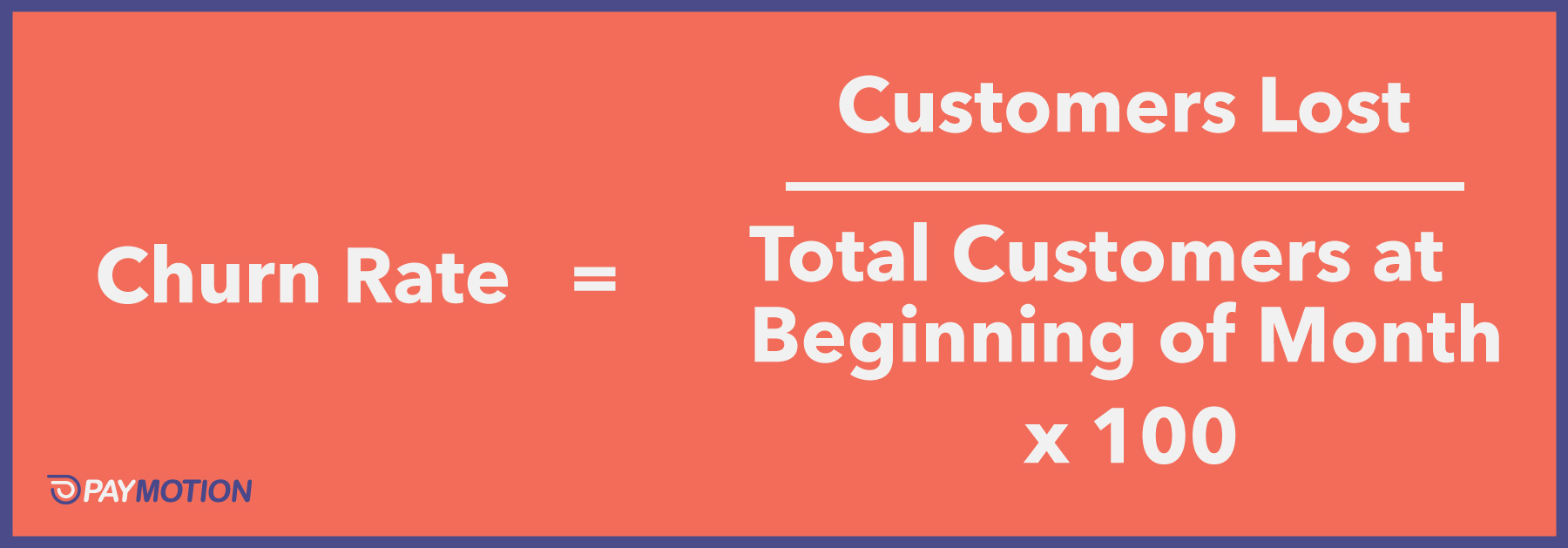

The churn rate (more specifically known as the “customer churn rate”) is the percentage of customers who cancel their subscriptions over a given time period. The formula for churn is as follows:

Churn is one of the most critical metrics in SaaS, since an overly high churn rate can make it very difficult to sustain growth. And unlike many other entrepreneurial challenges, churn actually becomes more of a problem the larger you grow.

In the early days, when your customer base is relatively small, losing 5% of your customers might not be a big deal. However, as you expand, that 5% can quickly balloon into a very large number in absolute terms. At some point, it becomes impossible to replace churned customers with new acquisitions. After all, it’s much easier to replace 5 out of 100 customers each month than it is to replace 500 out of 10,000.

While the acceptable churn rate will vary across different markets, as a general rule, you should aim for churn of 3% or less. Companies that sell to smaller businesses will be on the higher end of that range, while those that sell to large enterprises should expect significantly less.

There are three key steps you can take to reduce churn:

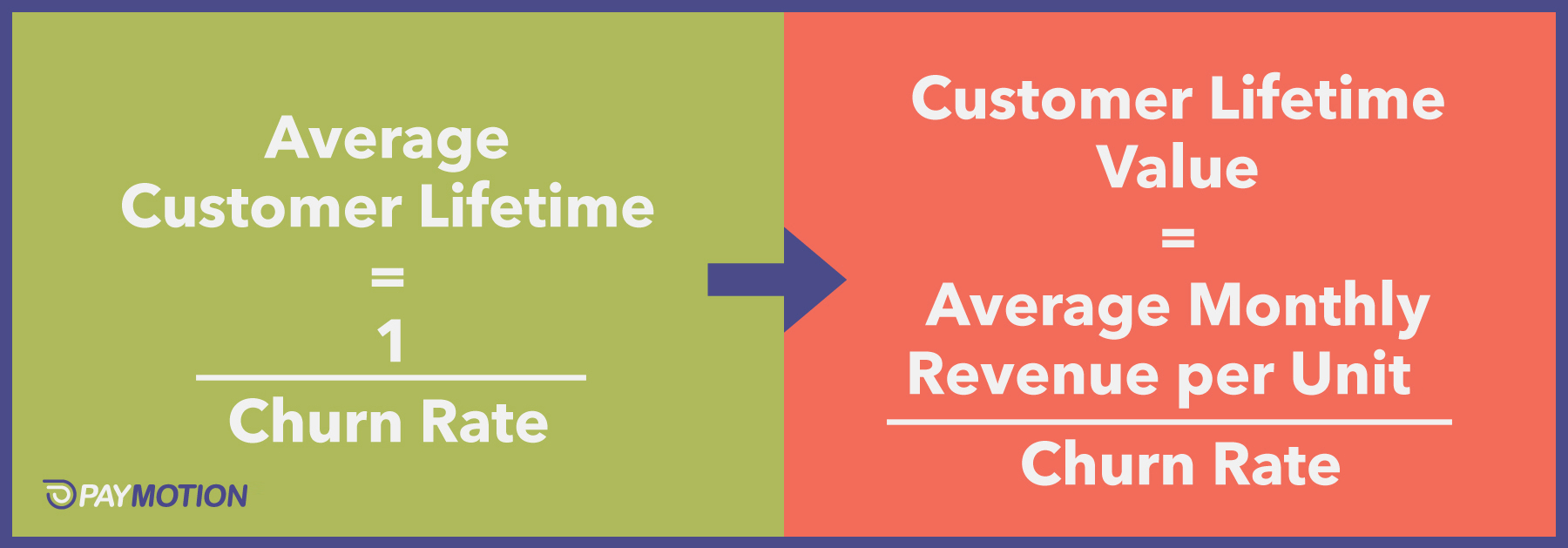

Customer lifetime value refers to the total revenue generated from your average customer over the course of the entire relationship.

Calculating CLV is a two-step process. The first step is to determine the average customer lifetime in months, as follows:

For example, if your churn rate is 2.5%, then you would divide 1 by 0.025, for an average lifetime of 40 months. Then, you would multiply this by the average monthly revenue per unit (ARPU) to get your CLV:

In our example, if the ARPU was $100, the CLV would be 40 x $100, or $4,000 in total.

CLV is a very important SaaS metric, because it forms the foundation of MRR and determines how much you can afford to pay for new customers (more on this below). In the words of SaaS entrepreneur Joel York, “SaaS customer lifetime value drives SaaS company value. For what is a company if not the sum of its customers?”

CLV also acts as your main bulwark against the growing menace of churn. As mentioned earlier, there comes a point in any SaaS company’s growth where new user acquisition will no longer be able to make up for churn. At that point, the only way for the company to keep growing is to successfully expand the CLV of existing customer accounts.

The reason for this is that it’s much cheaper and easier to get revenue from existing customers than it is to get a new sign up. Pacific Crest’s 2016 survey of SaaS companies found that they spent a median $1.13 to acquire each dollar of revenue from new customers, while each dollar from existing customers cost a mere $0.20-$0.27. Clearly, once a company has acquired a substantial customer base, expanding CLV is the way to go.

There are three main ways to grow CLV:

Customer acquisition cost (CAC) measures the total cost of acquiring a new customer. It’s calculated as follows:

CAC is an essential piece of the SaaS puzzle because in order to be viable, a company must be able to acquire new customers at a sufficiently low cost. In fact, CAC is so important that venture capitalist David Skok has labeled it “The Startup Killer”, since it has been responsible for more failed startups than almost any other single factor.

According to Skok, there are two goals to shoot for when it comes to CAC:

Skok points out that many of the most successful SaaS businesses got that way by pioneering innovative new methods to lower CAC, which allowed them to significantly overshoot these benchmarks. For instance, publicly-traded SaaS companies like Salesforce and Constant Contact have CLVs that are more than 5x their CAC.

Some of these innovative techniques include:

By employing some or all of these methods, SaaS companies can significantly reduce their CAC and accelerate their growth.

While most companies will benefit from measuring additional indicators relevant to their business, the ones explored in this article are a great place to start.

No matter which metrics you choose, consistency is the key to success. The more regularly you update and monitor your numbers, the more insight they will provide.

[pardot-form width="100%" height="280" id="10814" title="Blog Form: B2B Saas Pricing Guide"]